Chart of the Week: How Treaty-protected Fossil Fuel Projects Could Delay Climate Action

By Samantha Igo

Decisive climate action to cut carbon emissions within the next few years will be essential for decreasing the odds of breaching the 1.5C threshold of global warming.

However, as governments prepare for complex energy transitions, actions to halt oil and gas production – like cancelling pipelines or drilling permits – could be met with costly claims for compensation from investors.

A new study published in Science by a team of researchers at the Boston University Global Development Policy Center, Colorado State University and Queen’s University in Canada estimates the costs of such claims from oil and gas investors using a legal mechanism called investor-state dispute settlement (ISDS). They find ISDS claims for canceled oil and gas projects could reach $340 billion, diverting a substantial amount of public finance from essential mitigation and adaption efforts to the pockets of fossil fuel investors. For context, global public climate finance topped $321 billion in fiscal year 2020.

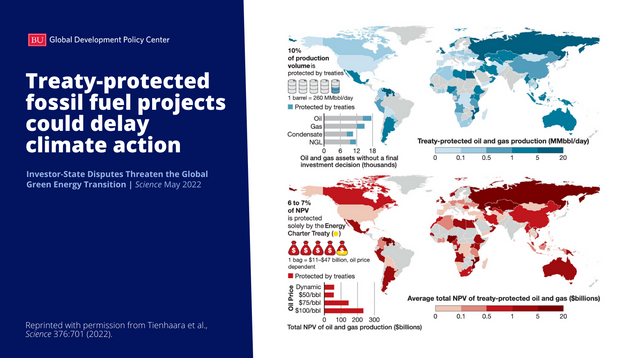

This Chart of the Week, Figure 2 from the study, visualizes how much oil and gas, both in million barrels a day (MMbbl) and price in billions of dollars, are protected by treaties that offer the controversial options of ISDS.

Figure 1: Treaty-protected Fossil Fuel Projects Could Delay Climate Action

The study quantifies risk under two scenarios. The first follows the Net Zero Emissions Roadmap from the International Energy Agency that imagines countries worldwide cease all new fossil fuel investment as of December 31, 2021. The second scenario charts a more ambitious trajectory, accounting for countries cancelling all fossil fuel projects that are not yet producing oil or gas.

Under the first scenario, more than 10,000 fossil fuel assets are covered by international trade treaties offering ISDS, with investments ranging between $60-234 billion. Mozambique, Guyana and Venezuela face the most severe financial and legal risk, between $5-31 billion. Under the second scenario, the numbers rocket to $92-340 billion.

One agreement in particular, the Energy Charter Treaty (ECT), represents nearly 20 percent of ISDS risk to countries. This European-centric, plurinational agreement is currently under contentious debate by member states on the issue of phasing out fossil fuel protections. The ECT is set to have a final decision at the Energy Charter Conference on June 24, 2022, as the European Union faces pressure from climate advocates to exit the agreement.

While ISDS poses a formidable roadblock to swift and meaningful climate action, the full impact of these investor-state disputes is avoidable. The study outlines three key policy recommendations to help preserve the integrity of climate action by governments around the world. First, countries may terminate their treaties to avoid ISDS, following the example of South Africa and others. Second, countries can bilaterally negotiate removing ISDS, assuming all parties agree to do so. Third, countries may be able to withdraw consent to ISDS for cases involving fossil fuel investments, though it is possible this approach may give rise to inter-state disputes.

Countries have the tools to secure a climate resilient future, and coordinated action on removing ISDS from international trade agreements will be a vital part of that.

Read the Journal Article*

Never miss an update: Subscribe to the Global Economic Governance Newsletter.