Finding Opportunities for Debt-for-Climate/Nature Swaps with China: Webinar Discussion & Interactive Launch

On Weds., Feb. 3, the Global Development Policy (GDP) Center hosted a webinar discussion and interactive demonstration of its latest research on opportunities debt-for-climate and debt-for-nature swaps with China. The research includes a journal article published in Science, a blog summary of the methodology and main findings, as well as an a new interactive tool where users can explore the suitability of countries for debt-for-climate and debt-for-nature swaps with China.

The webinar included GDP Center Director Kevin P. Gallagher, Senior Researcher Rebecca Ray, Post-Doctoral Research Fellow Blake Alexander Simmons, along with Prof. Carlos Larrea of Universidad Andina Simón Bolívar, Ecuador, and Shuang Liu of the World Resources Institute.

Kevin Gallagher kicked off the discussion by noting the world is current facing myriad crises, including the COVID-19 pandemic, climate change and a ballooning levels of sovereign debt. “2020 saw the biggest economic downturn since the Great Depression and pushed 150 million people into extreme poverty. It was also the hottest year on record, triggering forest fires, hurricanes, droughts, & other extreme events that accentuated the economic shock the COVID-19 pandemic brought to the world economy.” He also commented checking sovereign debt will be critical for combatting the virus and launching a green and inclusive recovery. “China has proven to be the largest and most active participant in debt relief schemes in 2020. Today’s discussion explores that leadership and how it can be linked with green initiatives.”

Following Gallagher, Rebecca Ray introduced the GDP Center’s research findings, noting that, “As the world’s largest bilateral creditor, China has immense potential for sustainability-enhancing debt renegotiations. Specifically, we identified 41 countries with relatively high exposure to Chinese debt.”

The GDP Center research assessed which countries would be suitable for debt-for-climate and/or debt-for-nature swaps with China based on significant exposure to both Chinese debt and threats to climate/biodiversity. The charts below demonstrate the assessment:

Figure 1: The Global Expanse of Chinese Debt Exposure

Source: Reprinted with permission from BA Simmons et al., Science 371: 466-468 (2021).

Figure 2: Environmental Threats within Countries of High Chinese Debt Exposure

Source: Reprinted with permission from BA Simmons et al., Science 371: 466-468 (2021).

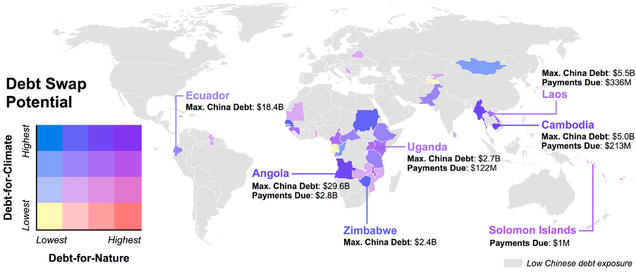

Based on this assessment, the GDP Center was able to create a global outlook for opportunities, “showing where the greatest opportunities for debt-for-climate and debt-for-nature swaps with China are around the world – including Cambodia, Laos, Myanmar, Uganda and the Solomon Islands,” according to Blake Alexander Simmons.

Figure 3: A Global Outlook of the Potential for Debt Swaps in Countries Under Greatest Chinese Debt Exposure

Source: Reprinted with permission from BA Simmons et al., Science 371: 466-468 (2021).

Following the presentation of main findings, Blake A. Simmons demonstrated how to use the interactive to create maps and scatterplots with the data from the GDP Center analysis (including financial, environmental, and opportunity data), see the variation in these characteristics between countries, and how the relationships between different variables may be useful for prioritizing countries for green debt relief strategies, like debt swaps.

Next during the panel discussion, Carlos Larrea gave an overview of a recent proposal he co-authored explaining why Ecuador would make for a good candidate for a debt-for-nature with China. He commented on the richness of Ecuador’s biodiversity, while also noting that the country is faces a significant amount of sovereign debt owed to China and others that constrains the country’s abilities to fund some of its commitments under the Paris Agreement.

Shuang Liu discussed her recent research exploring opportunities for “climate-heath-debt swaps,” commenting that health is also an important aspect to take into consideration and that health or other social indicators could help set a precedent to include climate and nature in future debt relief negotiations.

A Q&A session with the audience followed, moderated by Kevin Gallagher.

For more information on the GDP Center research on China and debt-for-climate and debt-for-nature swaps, see below:

Explore the Interactive Read the Journal Article Read the Blog Read the Op-Ed